Key Aspects of the Brazilian ConsumptionTax Reform

On November 8th, 2023, Brazil’s Federal Senate approved the Constitutional Amendment Bill No. 45/2019 (“PEC 45”), which introduces a new model of consumption taxation, a key step towards simplifying Brazil’s tax legislation. The bill has now returned to the Chamber of Deputies (House of Commons), where it will likely be endorsed.

Considered essential for the Brazilian economic development, the enactment of a less complex consumption tax system is approaching a conclusion, putting an end to discussions that have been ongoing for more than 30 years.

Here, we briefly present the main points of the consumption tax reform:

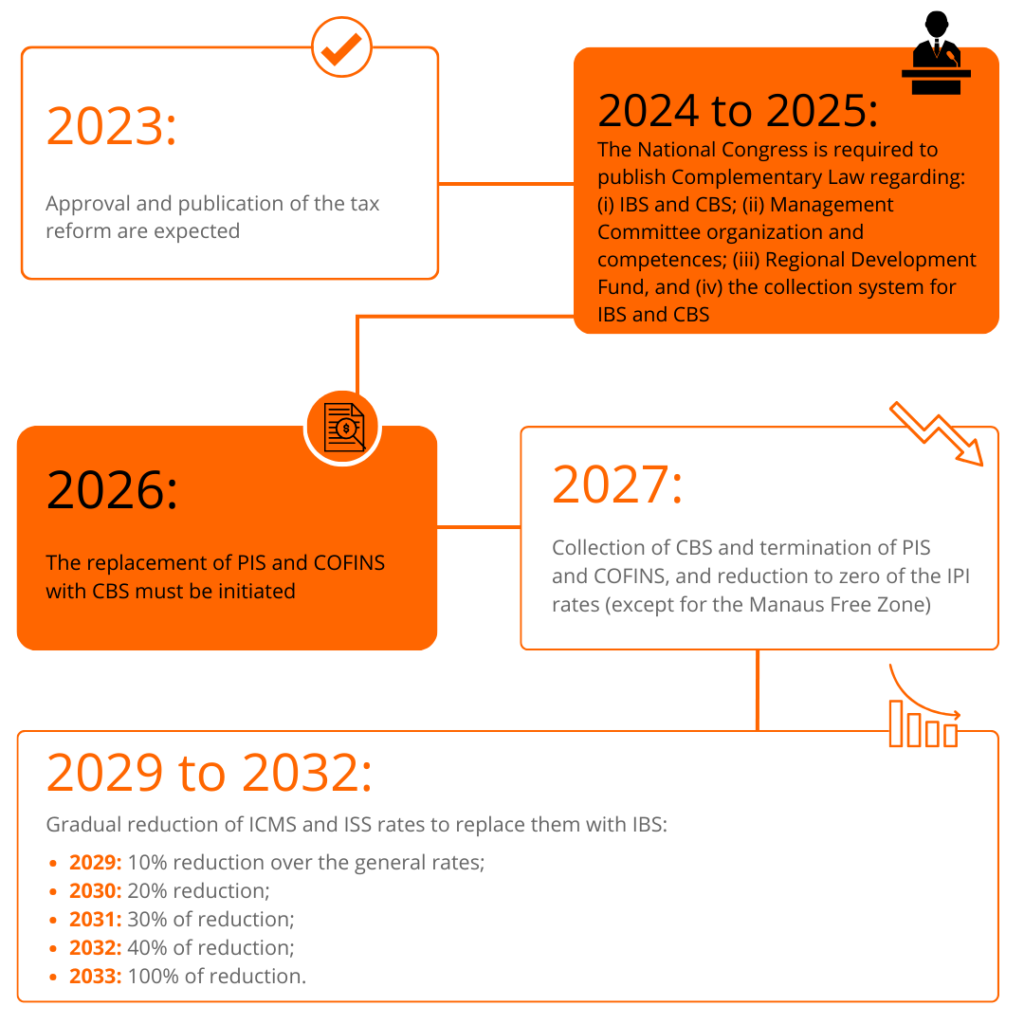

Transition Period

Both systems will coexist until 2032, potentially increasing the complexity of the tax system during the transition period. Here’s the schedule: